Effectively managing cash is critical to the success of every business. Lack of visibility into daily balances can lead to serious financial difficulty. NetSuite Bank Feeds provides businesses access to up-to-date financial data, eliminating inefficient manual processes and providing greater control of cash resources. With it, businesses can connect to thousands of financial institutions across Australia and New Zealand, and automatically import bank and credit account balances and transactions history into NetSuite.

Key Benefits

- Automate bank account management and reconciliation. Create and post transactions automatically from imported bank data.

- Up-to-date data allows financial managers to make informed decisions about how and when to allocate cash.

- Improved tracking of payments, credit card charges and bank balances helps ensure financial resources are being used for the good of the company.

- Regular reconciliation of bank and credit card transactions makes balancing the general ledger easier, saving time during the close process.

Banking Integration

Automate the import of bank and credit card data from financial institutions across North America, Europe, Asia, Australia and New Zealand, giving finance and treasury personnel a clearer view of daily cash availability.

Automated Reconciliation

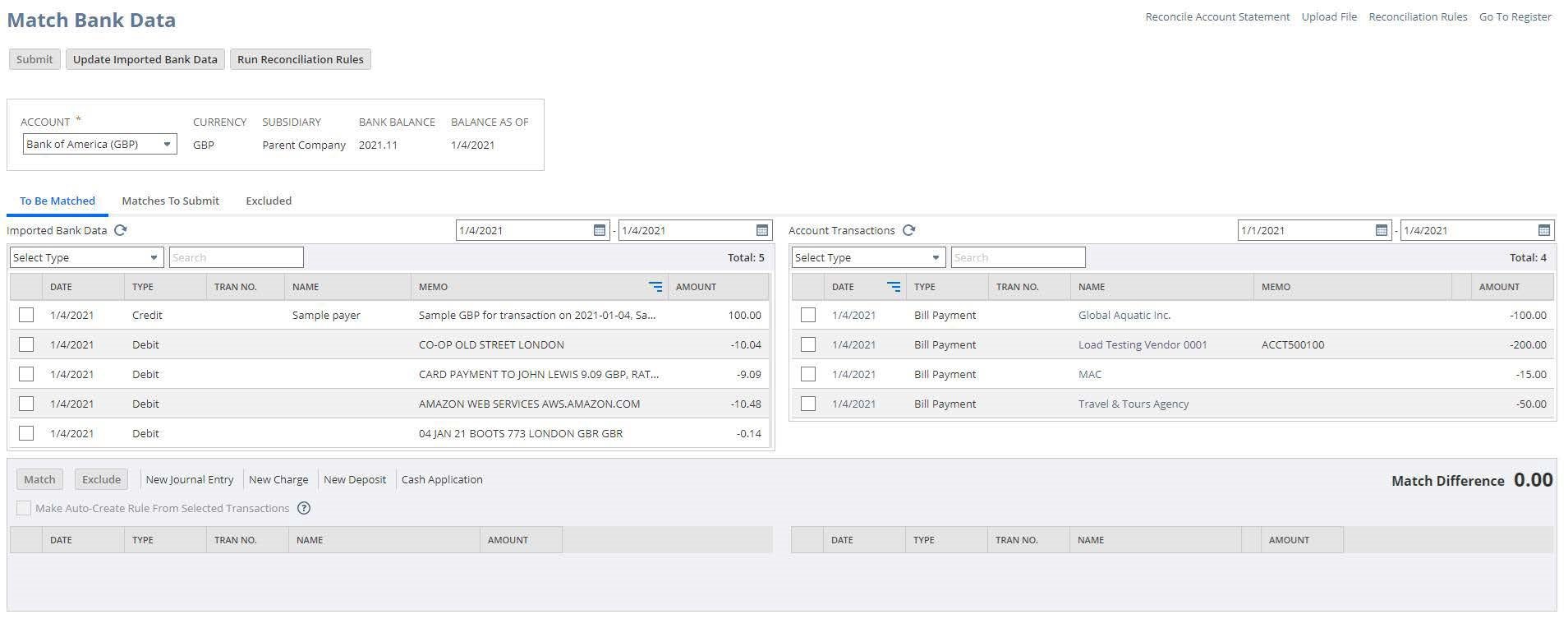

Reduce the time and effort required to reconcile bank and credit statements with general ledger accounts. An intelligent rules engine compares bank data to existing transactions, automatically reconciling matching entries and flagging exceptions so they can be corrected manually.

Match Bank Data:

Auto-Post Journal Entries

Bank Feeds automatically creates posting transactions from imported bank and credit card data based on user-defined criteria. Save time and minimize the risk of errors by reducing the need to manually create and post charges, refunds and deposits. It works in combination with the reconciliation process to auto-post journal entries, allowing accounting personnel to focus on managing exceptions.

Interested in finding out more about how NetSuite can help automate your banking process?